Bajaj Auto reports 9% growth in September sales:

In a highly competitive Indian auto sector, companies constantly vie for incremental gains. So when Bajaj Auto reports 9% growth in September sales, it signals more than just a quarterly uptick — it underscores resilience, strategic positioning, and positive momentum. In this blog, we’ll dissect this performance, dig into the numbers, understand the drivers, and see what lies ahead.

1. The Big Picture: Sales Numbers That Speak Volumes

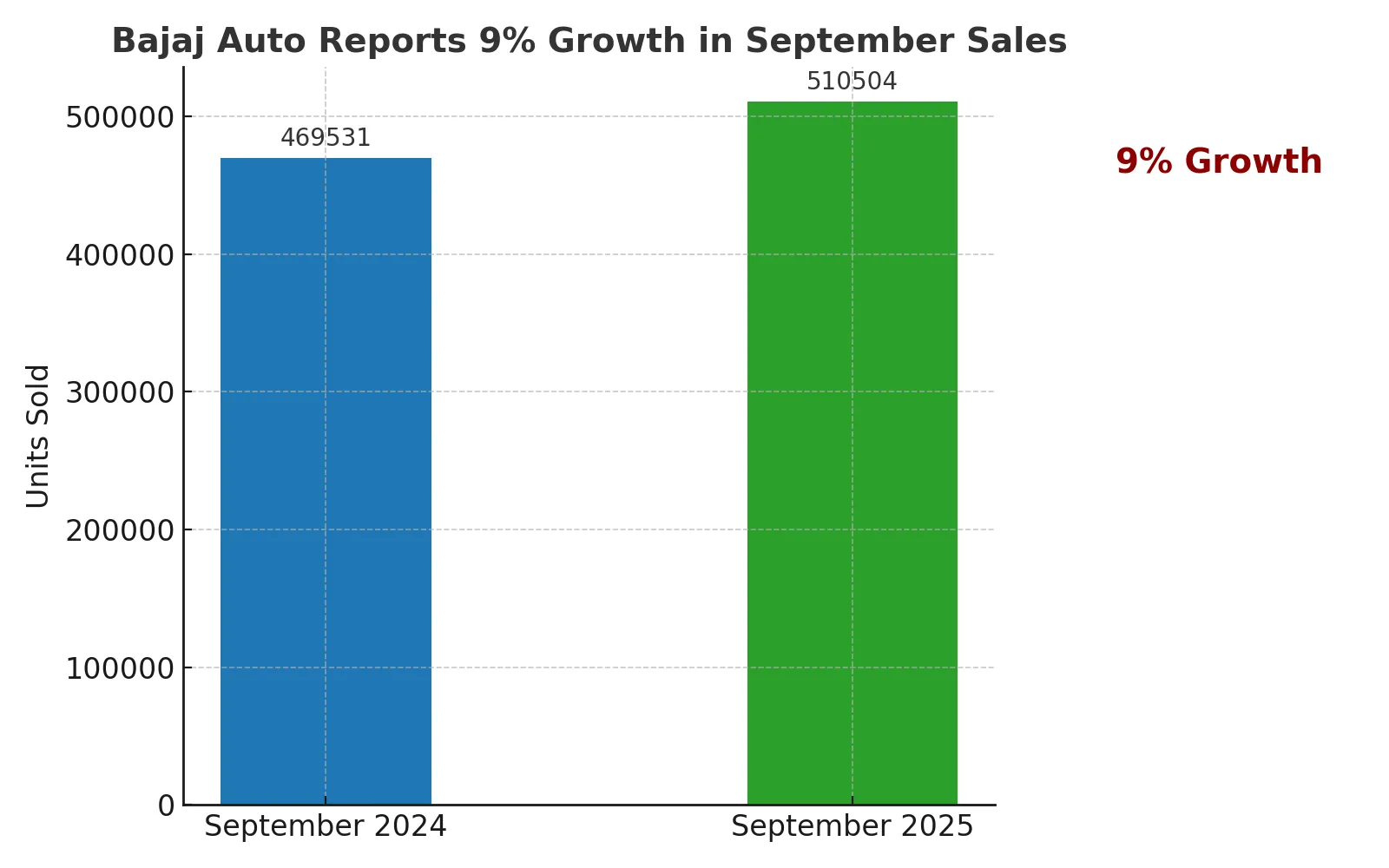

In September 2025, Bajaj Auto recorded total vehicle sales of 510,504 units, representing a 9% year-on-year growth over 469,531 units sold in September 2024. MarketScreener

This achievement is especially notable given the challenges in domestic demand and the volatility in global supply chains. It shows that Bajaj’s diversified mix and export strength are paying off, Bajaj Auto reports 9% growth in September sales.

2. Segment Breakdown: Two-Wheelers & Commercial Vehicles

While the headline 9% growth captures overall performance, it’s crucial to dive deeper into segment-wise trends:

-

Two-Wheelers: Being the core segment, Bajaj’s two-wheeler business saw healthy traction, with export markets buoying growth, even as domestic demand remains inconsistent.

-

Commercial Vehicles / Three-Wheelers: Growth in this segment, though more modest compared to two-wheelers, added stability to the overall numbers. The company’s footprint in utility vehicles and intra-city transport solutions supports this base.

That said, precise disaggregated numbers (e.g. domestic vs export split for September 2025) were not publicly detailed in the sources I found at this moment.

3. Trend Context: How Does It Stack Up?

To better appreciate the 9% growth in September, it’s useful to see trends from recent months:

-

In August 2025, Bajaj Auto sold 417,616 units, up 5% year-on-year. The Economic Times

-

For the period from April to August 2025, total sales stood at 1,894,853 units, marginally up ~2% compared to the same period in 2024. www.ndtv.com

So, the September jump helps accelerate the year-to-date growth profile and demonstrates that Bajaj’s momentum is improving deeper into the fiscal year.

4. Catalysts Behind the Growth

What factors may have driven the 9% growth? Here are some plausible drivers, backed by industry observations and company trends:

a) Export Strength

Bajaj has been leaning heavily on exports to offset domestic headwinds. In months prior, its export growth has outpaced domestic demand recovery, acting as a cushion. The Economic Times

b) Product Mix & Premium Models

Growth in higher displacement or premium segment bikes helps improve revenue and margins even if volumes are modest. Bajaj’s global associations (e.g. KTM, Triumph) and its domestic premium bike portfolio assist here.

c) Supply Chain & Input Cost Management

Companies with better supply chain resilience and cost control strategies typically outperform during stress. Bajaj’s ability to manage component shortages or raw material fluctuations could have played a role. (While not explicitly reported in the recent press, this is a recurring theme in auto sector analysis.)

d) Festive & Consumer Sentiment Tailwinds

September often aligns with the lead-up to festive season demand in India. With announcements of tax rationalisation and consumer stimulus in various auto segments, the environment becomes more favourable. Also, recent GST rationalization moves are expected to spur auto demand. The Times of India

5. Risks & Challenges to Watch

While the 9% growth is encouraging, several headwinds are worth noting, Bajaj Auto reports 9% growth in September sales:

-

Domestic Demand Uncertainty: Rural cash flows, inflation, and interest rates can dampen consumer appetite for two-wheelers.

-

Input Cost Pressures: Commodity and logistics inflation can squeeze margins if not passed on.

-

Global Volatility & Currency Risk: Export exposure means vulnerability to foreign exchange swings and geopolitical disruption.

-

Competitive Intensity: Rivals (TVS, Hero, etc.) and new EV entrants may erode share or compress margins.

6. What This Means for Stakeholders

For Investors:

The growth reflects operational early traction and could boost market confidence in Bajaj’s strategy, especially if this trend sustains into Q2 and beyond.

For Dealers & Distributors:

The lifting demand in September could mean inventory rotations, more aggressive targets, and opportunities for newer launches or schemes.

For Competitors:

Bajaj’s export + product-mix focus may pressure peers to reorient strategies, especially those overly dependent on domestic volumes.

7. Outlook: Can Bajaj Keep Up the Momentum?

Sustaining 9%-plus growth will require that the underlying drivers remain intact and possibly strengthen. Bajaj Auto reports 9% growth in September sales, some indicators to watch:

-

October–December (Festive quarter) Sales Data: This season is usually decisive in the Indian auto cycle.

-

Quarterly Financials & Margin Trajectory: Volume growth is one side; margin preservation is just as critical.

-

Export Market Trends: How global demand, trade policies, and supply chain conditions evolve.

-

Policy Interventions: GST, subsidies, incentives—any favorable regulation will help the industry.

Given the trajectory so far, if Bajaj can combine volume growth with margin discipline, its performance for FY 2025–26 could stand out among Indian OEMs.

Also Read: https://grandautoworld.com/re-classic-350-navratri-buy/

Conclusion

When Bajaj Auto reports 9% growth in September sales, it’s not merely a one-month scorecard — it’s a proof point of resilience, strategic diversification, and solid execution. Coupled with momentum from exports, improved mix, and favorable market conditions, this performance gives strong signals for the rest of the year.

However, challenges remain. The auto sector is cyclical, and sustaining growth will require agility, cost controls, and a sharp pulse on market sentiment. For stakeholders—from investors to dealers—monitoring October and Q3 will be critical to confirming whether this is a sustained upswing or just a fleeting flash.